Contents

Forex is a high-risk trading instrument which is not suited for all traders and investors. ITRADER is a brokerage company offering trading services for clients since 2016 with offices in Cyprus. A regulated broker equals a more responsible trading environment. Trading platform is a tool where you can buy or trade an instrument with only some clicks on your device, anytime and anywhere you want. In addition, price chart is also usually provided with some analytical tools to help you analyze the price movement, so you can increase your profitabiliy by placing well-planned trades. Besides lots of currency pair, ITRADER also offers some instruments you would like to trade on, such as Forex, Gold & silver, Stocks, Indexes and Cryptocurrencies for your best choice.

Minimum deposits on all accounts are 250 USD, EUR or GBP. ITrade provides a free option to trade using their Trading Desk software. It is a 1 page trading console where investors can optimize their trades – entering multiple stock or options orders to create quick scenarios. The Mutual Fund screener is extremely easy to use, allowing filters by price, type, and yield.

In Europe each country has its own regulations, the same for Australia and the United States . Itrader does not have any regulated licenses while offering trading to Europe,USA and Australia. All of our reviews are based on https://forex-reviews.org/ research carried out by professionals. Some traders have complained that account managers asked them to deposit more money, others have complained that they had to send ID verification and others call them an outright Scam.

Assistance can be provided in English, Italian, German, Russian, Spanish, Dutch, and Portuguese. Other markets include commodity CFDs, which are limited to commercial names in Europe, Australia and the United States, as well as a selection of global markets such as oil and gold. Ultimately, deciding which leverage level to choose depends on the individual trading strategy and the actual vision of upcoming market moves. In order for a trader to make a profit or avoid making a loss on a trade, the price must move enough to make up for the cost of the spread. Though it seems simple enough, picking the right account is one of the most important aspects in deciding on the right broker, as the account type can have a direct impact on profit and loss.

There is absolutely no reason why you should invest your money in this online broker. This is a scam and a very unprofessional service that only wants to steal money from clients. While getting involved in trading and investing is always risky, there are legit alternatives out there. So, as this Itrader review itrader review has revealed, we clearly DON’T RECOMMEND them as your online forex broker! Even if their website looks professional and everything seems fine on the surface, it only takes a little digging to find out who they truly are. Stay away from such services if you don’t want to lose lots of money for nothing.

This broker offers good choice of platforms as well as awesome choice of trading accounts. Additionally, it has very useful educational section, which is vital for beginners. We recommend you to start trading with Global.ITRADER Forex broker. Furthermore, Global.ITRADER broker offers floating spreads for all real account types. There is nothing bad in floating spreads and most of the time they will be lower that fixed spreads offered by other Forex brokers.

In order to attempt to protect client funds, money is separated into different bank accounts. ITrader also opted for some protection with the Cyprus Investor Compensation Plan. However, the spreads offering are a bit higher than the average industry proposal. Nevertheless, iTrader is also a regulated broker which means the company follows and bringing a clear and calm state of mind that your money safe. Overall, through the years of operation, iTrader presented themselves as an active and trustable trading provider, as well has gained awards as one of the leading industry brokers.

Once you’ve read over all the legalities and you’re ready to get started, you will be offered three choices to choose from. Tech specs and perks increase as you approach platinum packages. The main distinction between the Gold/Platinum and Silver options is the addition of a personal manager. Claim your profile to access Trustpilot’s free business tools and connect with customers. “Hoch Capital Ltd is not permitted to provide regulated financial services to residents of the United Kingdom.” – FCA mentions, read more by the official warning link.

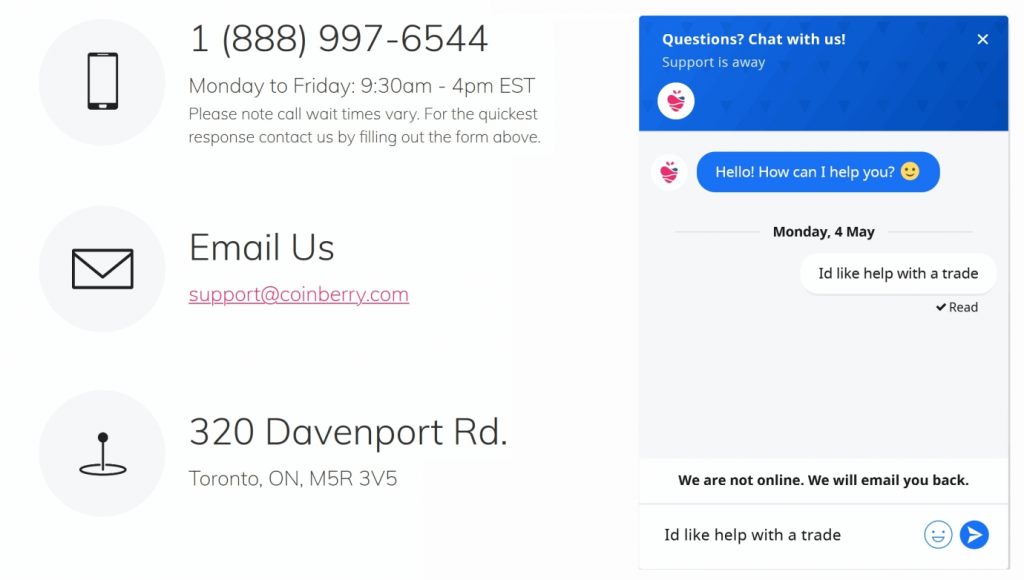

I was making good progress by my own conservative approach up to £2200 until the agent advised me to add an exotic currency. I was reluctant in the beginning but said it has good prospect. The customer support can be reached via live chat, email, fax and phone.

Also, fully regulated by CySEC and registered with more than 20 other financial watchdogs across Europe. You will only find out the deposits for each account type after you create an account and deposit the minimum of 250 EUR/USD. Ok, you have my best interest in mind, but I would still like to know from the get-go how much each account requires me to deposit. In light of the recent settlement reached between Hoch Capital and CySEC, the company appears to understand the need to provide a better service. So let’s hope they’ve learned the lesson and will become a more reliable broker. Almost all of the 4 and 5-star reviews look similar and are written in broken English.

ITRADER offers customers a range of deposit and withdrawal options. The company does not charge any fees for these options and the minimum withdrawal amount is $100 per request. Withdrawal requests are processed within one business day. If scamming people through CFD manipulation isn’t enough, Itrader is also known for posting phony reviews. If you do a Google search for “Itrader review”, the first several links read more like an advertising brochure than a review.

The size of the spread is determined by the trading account type, i.e. Hello everyone it is possible to retrieve your stolen bitcoins. I never believed in bitcoin recovery because I was made to understand that it is not possible. But sometime in DECEMBER I fell for a binary options scam which promised a higher return and I lost close to $75,000.

Meanwhile,iTrader is also an official online trading Partner of Manchester City Football Club in EMEA. Therefore, the exercise of iTrader investment activities and the operation of regulated markets is in accordance with the rules of MiFID in the European Union, which has the right to cross-border services. The latter is also owned by a company called Bayline Trading Limited, located in Belize. Both of these companies do NOT have a license from CySEC.

If you are a victim of this broker, you must complete the file below or use the online chat if the amount lost is greater than $5,000 to be put in direct contact. Your chances will depend on several things like payment history, method of payment. Each file is different but MyChargeBack knows all the procedures to speed up your file. If you want to know more about the procedure, click here. Their asset basket is wide, including currency pairs, indices, commodities, stocks, and a hefty selection of cryptocurrencies. Spreads are floating and change depending on the account you have.

Asset index gives traders a detailed menu of the assets available. Traders should also keep in mind potential hidden fees that some brokers might charge, which include inactivity fees, monthly or quarterly minimums, and margin costs. A commission is similar to the spread in that it is charged to the trader on every trade placed. The trade must then attain profit in order to cover the cost of the commission. The spread is the difference between the bid and sell price of a currency pair, and what the broker charges, and is fundamentally how brokers make a profit.

No, ITRADER is positioned toward more experienced traders as its initial minimum deposit is fairly high and it does not offer as many educational tools as other brokers. ITRADER offers multiple instruments across forex, commodity, CFD, index, and stock markets. Traders gave access to a range of currency pairs with spreads as low as 0.7 pips for the EUR/USD pairs. A competitive selection of cryptocurrencies is also offered.

Questrade or CIBC Investors Edge may provide greater flexibility or lower costs for seasoned active traders. With their ear to the ground, it would be no surprise if Scotia iTrade leads the pack with innovative product and service offerings that meet the needs of a new generation of investors. Once the application is submitted, iTrade may require special forms to complete approval. For example, when opening a registered account such as a TFSA, the federal government requires a unique form in paper format that needs to be mailed in.

So i’m very pleased with trading on such a reliable platform, with professional assistance. It’s also worth noting that Itrader has some very pushy “investment advisors”. These people call clients on a daily basis and use aggressive tactics to make more money. According to former clients, these people can sometimes call multiple times a day asking for more money for investments.

It’s a well-known fact that nowadays all brokers ask for IDs in order to prevent money laundering so the fact that ITRADER asks for these documents should be considered normal, not a cause for concern. One common complaint from former Itrader customers is that their “investment advisors” behave more like salespeople than actual advisors. They call on a daily basis, sometimes more than once, which just isn’t normal unless you’re investing tens of millions of dollars or more. The Islamic account, also known as swap-free, is designed especially for Muslim clients who follow the rules of Sharia law.

There is a Scotia iTrade app that provides limited features when compared to the desktop counterpart. The interface is simple and intuitive making is easy to access accounts, quotes, watchlists, orders, and transfers. It is also possible to read market news and view data analysis. Most complaints from users focus on instability and network problems encountered when updates are installed.

The bank of Nova Scotia has been around since the early 1800’s. Operating as Scotiabank, it is part of Canada’s big five and a dominant force in the country’s banking industry, boasting over 26 billion dollars in revenue and holding over 850 billion in assets. Nonetheless, your comment was forward to one of our reps who will have a review of your account, and will contact you accordingly.

The entire responsibility for the contents rests with the commentators. Reprint of the materials is available only with the permission of the editorial staff. Scotia iTrade offers TFSAs, RRSPs, RESPs, RRIFs, LIRAs, and LRSPs. When using registered accounts, investors have the option of trading U.S equities and options for a flat fee of $30 per quarter.

Leave a Reply